So, what is Dingosoft Ledger Manager? Good question! We’re not really sure. We think it’s a “multipurpose subledger”.

Remember the old manual accounting journal and ledger books? They were just blank pages divided up into various vertical columns. They didn’t have a specific purpose – you could use them for whatever you liked. They were “multipurpose”. When accounting became computerised we developed specialised journals and ledgers – like accounts receivable and inventory. These subledgers are great at what they do, but there are only a handful of them. What if you wanted a subledger for some other balance sheet account?

I’d like to be able to say that we thought this all through logically and realised in a flash of brilliance that what was needed was a true multipurpose subledger, but what really happenned was we kept getting enquiries from prospects asking if our Trust Accounting module could do this or that or some other thing (we think about half the users of our T/A product are using it for some purpose other than trust accounting). We could see that T/A was close to what many of these prospects wanted, but being a specialised sub-ledger, it had restrictions that got in the way. So about 15 months ago we started developing an alternative that was flexible enough to do all the things these prospects wanted. After many iterations, we have a product that basically evolved into what we only realised in hindsight is a multipurpose subledger. Like they say, “necessity is the mother of invention”.

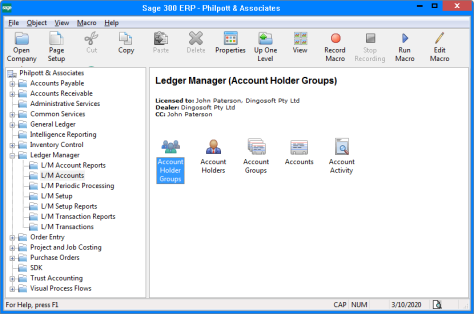

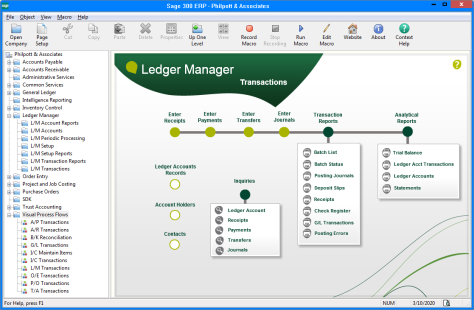

Basically, Ledger Manager is a standard Sage 300 submodule, developed in the Sage 300 SDK with strict adherance to Sage 300 standards and has all standard features. It has accounts which can have a debit or credit balance as well as the usual account groups, account sets etc. It has a separate account holder database, so you can optionally attach account holders to accounts. Account holders can have multiple contacts. All contact info is held in our Contact Manager module, so only ever needs to be changed in one place. It has full batch processing of cash receipts, cash payments, journals and transfers between accounts. It has average daily balance interest calculation with multiple options for interest payout/reinvestment etc. It prints statements as well as all the usual reports. It has an account reconciliation function for matching debits off against credits. It handles quantities, with accounts having both an amount as well as a quantity balance (think shares/units for funds etc). It is multicurrency and handles tax, salesperson commissions and has full bank and G/L integration. Standard features include optional fields, import/export and VBA macros. It also integrates with our EFT Services module. We even have Visual Process Flows:

So what can you use it for? Well really, every prospect so far is different. It can be used as a subledger for pretty much any balance sheet account. You could even use it as an A/R or A/P subledger by entering invoices as journals and using the reconciliation feature to match receipts/payments against the invoices. Of course you wouldn’t use it for that as the dedicated A/R & A/P modules would do a much better job of it, but I just mention it to give you an idea of what it can do. With it’s ability to track quantities you could probably even use it as a simple I/C module (again – not that you would). Probably more useful in finance than say manufacturing, it would actually be perfectly useful banking software with it’s multiple accounts per customer (including joint accounts etc.) all with central contact information. Average daily balance interest calculation and statement printing etc. And all for probably a few million dollars less than the next cheapest banking software. (Don’t laugh – we did actually have a small boutique bank as a prospect once!). The ability to track quantities also means that funds – as in mutual funds, hedge funds, pension funds etc. – are now prospects as you can have quantities in all transactions and maintain a unit or share balance for each account. We are also very open to evolving the product and adding new functionality if there is a particular industry that requires it. If you would like to discuss a particular use for the product, please contact info@dingosoft.com.au.

The 2014 and 2016 on-premise versions are currently available and the 2016 web user interface will be later in 2016.

More info at our website here: www.dingosoft.co