The Sage 300 Financial Reporter (FR) has a loyal following which is not surprising as it’s actually one of the most powerful financial reporters in the market. But it also has some drawbacks, not least of which is that it doesn’t work with Sage 300c. But does Dingosoft’s FRS have what it takes to be a viable FR successor?

All of Sage 300c’s competitors in the cloud have pretty decent, fully integrated financial reporters. NetSuite’s FR is great for online viewing with tree-like drill down on screen, but from what I’ve seen, possibly not so great as far as formatting of printed/distributed reports. MS Dynamics 365’s FR is based on Microsoft Management Reporter (previously FRx) which has always been popular and is probably the best of the bunch. Acumatica has an FRx-like financial reporter, but not as powerful – especially with formatting and Sage Intacct also has a basic FRx-like financial reporter, but it seems to lack the reusable row/column/data report “building blocks” that made FRx / MMR so popular.

Of course, all these ERP systems also come with various other reporting and Business Intelligence tools, for example Dynamics 365 also comes with MS Power BI, and Sage 300 has two BI tools, but a dedicated financial reporter is really a necessity in this class. So here at Dingosoft, we just spent the last two years re-developing the Sage 300 FR, converting it from an Excel add-in to probably the most powerful, fully integrated financial reporter in its class – capable of working with both Sage 300 and 300c.

OK, the 300c web screens aren’t available just yet, but Dingosoft’s new “Financial Reporter for Sage 300” (FRS) has to work with both 300 and 300c, so has to stack up against the current on-premise Sage 300 FR or it just won’t be seen as a viable alternative for current on-premise Sage 300 users, or users looking for a replacement for FR when migrating from on-premise to cloud/hybrid.

So, how does FRS stack up against FR? In some ways it’s difficult to make a direct comparison as it’s a bit of an apples vs. oranges situation. FR is an Excel based financial reporter like F9, whereas FRS is an FRx – like application. There are certainly pros and cons to both types of product. Excel add-ins like F9 are definitely more flexible as you have the flexibility of a spreadsheet at your disposal, whereas FRx-like applications are easier to use and more closely integrated.

FRS is however a lot more flexible than FRx because FRx prints directly to the printer, whereas FRS has similar features to FRx, but uses Crystal for printing which gives you access to all the additional power and flexibility of the Crystal Designer if you so choose. FRS is also more closely integrated than FRx as FRS is developed in the Sage 300 SDK, so is fully integrated with Sage 300, whereas FRx is an external app, designed to work with multiple ERP applications. In effect, we replaced the variable x (meaning it works with various accounting systems) in FRx with the constant S meaning it only works with Sage 300!

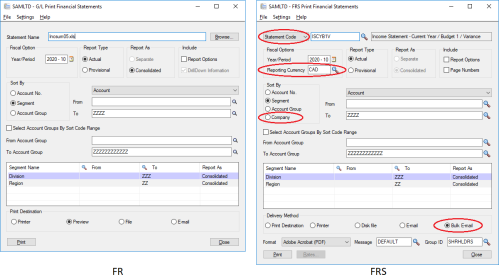

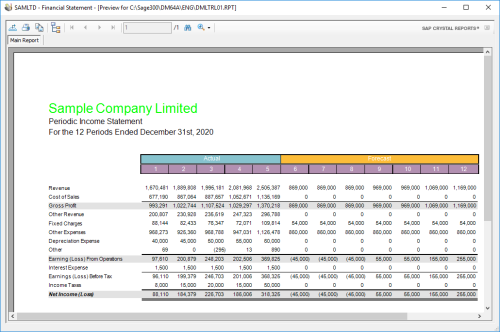

Printing Financial Statements

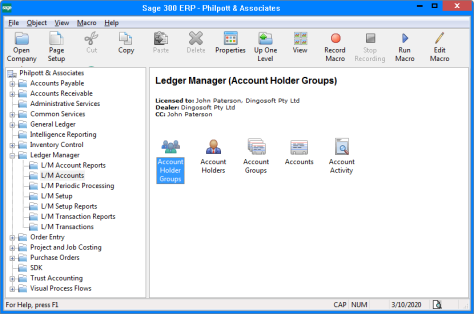

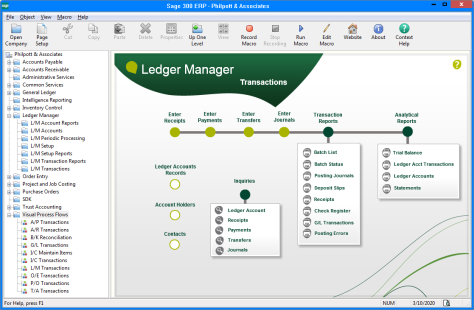

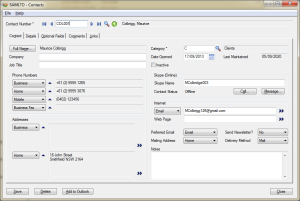

As you can see from the above screen-shots, FRS is clearly a re-write of the current FR. This was done intentionally in order to make a transition from FR to FRS as easy as possible with little need for re-training. There are some differences though.

Report Sets

The circled drop-down box at the top of the FRS screen allows you to switch between selecting a single Statement Code or a user-defined “Report Set”. FRS allows you to create groups of reports that can be printed / emailed etc. in one go, rather than having to print them all individually.

As you can also see on the first line, reports or report sets are selected with the finder and have a full description which is much easier than browsing for an Excel file.

Reporting Currency

FRS allows you to print any financial statement in any currency. Also known as a “Presentation Currency” in financial reporting, it’s a straight conversion of all the figures on the report at the report date rate. The “Rates” button at the bottom of the screen lets you select the rate to use. Useful if you have to report to shareholders / parent companies etc. in another currency.

Multi-Company Reporting

FRS allows you to report on any company / companies either separately or consolidated. Simply select the companies to report on – or set up your own “Company Groups” and hit the print button. No export/import, connectors or any other setup required. It’s not as flexible as the G/L Consolidations add-in, but G/L Consolidations costs about twice as much as FRS. It doesn’t have a “translation table”, but all the standard reports are based on the “Account Group Categories” which are the same for all companies, so it can consolidate companies with completely different charts or account groups. It also works with different functional currencies, year ends, number of periods etc. You can also print side-by-side multi-company reports by filtering on the company in each report column in the report designer. A sample side-by-side report using SAMINC and SAMLTD is included.

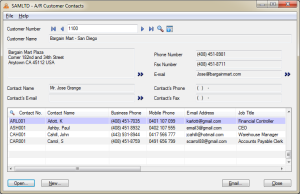

Bulk Emailing

As well as the usual print destinations, FRS allows you to set up E-mail Recipients and then add them to Recipient Groups. You can then email a single statement or report group to all the E-mail recipients in a group. You can use the default E-mail message or create your own with lots of options for “text variables” to customise the email.

Scheduling

FRS also works with the Windows Task Scheduler, so you can schedule printing/emailing etc. of report sets without even having to be logged into Sage 300. FRS also provides a command-line interface which can be used with anything you like. FRS is pretty fast, but if you have a lot of data, you can schedule all your financial statements to print to file overnight so that you never have to wait for a financial statement to generate again as you will always have all the latest reports on file. You can even use text variables in the destination folder and file names so that you can do things like include the year and period in the file name so that you build up a history of financial statements on file.

Statement Designer

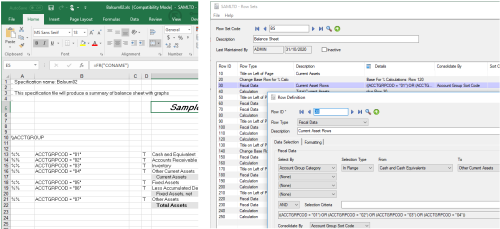

The statement designer is where you see a big difference between FR and FRS because obviously FR’s designer is in Excel, whereas FRS’s designer is in Sage 300. But even in the designer, FRS is conceptually based on FR making the transition from FR to FRS pretty easy.

Report Building Blocks

One of the biggest differences between FR and FRS is that FRS has FRx-like “Row Sets”, “Column Sets” and “Data Sets”. These are then used as the “building blocks” for multiple reports. So, you can for example create a row set for balance sheets and use that row set in multiple reports. This ensures consistency in your reports, saves time when creating reports and also means that if you need to make a change like adding a new row, you only need to add it once in the row set – rather than in every report.

Rows

Defining the rows in a report is a lot easier in FRS, especially if you are typing in account references in Column A like: “1000[ACC],4010~4150-200[ACCDIV]” as instead of trying to do everything in a single spreadsheet cell in FR, you have a whole screen with drop-down lists and finders etc to do the same thing in FRS. But even if you are using account groups in FR, it’s still a lot easier in FRS. You can even select by account group category, so that instead of having to define a row for each account group in a section, like current assets as in the screen-shots above, you can (in a single row definition) select a range of account group categories from “Cash and Cash Equivalents” to “Other Current Assets” and consolidate by account group which will give you the same result – plus if you make a change – like adding a new current asset account group, you don’t need to update your reports as it will automatically be included in the range.

Calculated rows have a number of easy to use calculation types for doing simple tasks like adding/subtracting multiple rows or totalling a range of rows with a simple point and click interface. For example, if you select the “Total Range of Rows” calc type, the screen just gives you two fields for “From Row” and “To Row” with finders to select the rows. However, if you select the calc type “Formula” you get a screen where you can enter complex multi-line formulas, similar to the formulas in Crystal. All of the standard reports however are designed without any formulas at all.

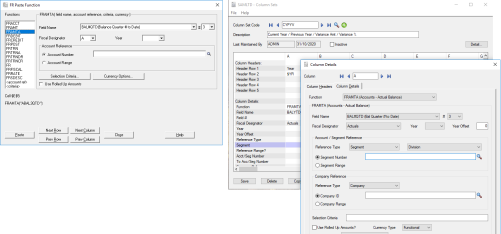

Columns

Defining columns in FRS is a lot like using FR Paste (except of course, it’s a regular Sage 300 screen – not a one-way “paste”). FRS has familiar “functions” like FRAMT, FRAMTA, FRDEBIT etc. and ALL the same fields, from “BALP” to “BALPY#PA” which is essential if you are migrating reports from FR to FRS. Also, whilst FR Paste provides fields for an “Account Reference” which allows you to filter the data in that column by account number, FRS also gives you a segment reference, making ‘side-by-side’ segment (eg: Division or Department etc.) reports a breeze. It also has a company or company group reference for easy side-by-side multi-company reporting. FRS also provides five column headers with a huge number of text variables. Calculated columns are similar to rows with both easy to use calc types as well as powerful multi-line formulas. The formulas allow you to do things like multi-line “switch” statements, which is a lot easier than having multiple nested If statements in a single Excel cell.

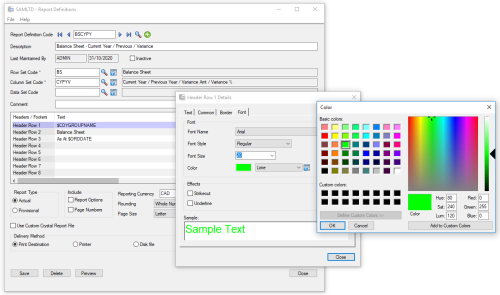

Formatting

FRS has powerful formatting capabilities built-in, so you don’t need to use the Crystal Designer for formatting. You have full control over the formatting of report headers, column headers and report rows. Pretty much any formatting you can do in Crystal, you can control from FRS.

You can select rounding options from “No Rounding” to “Whole Billions” with “Whole Numbers” being the default (seriously, who wants to see cents on a balance sheet?). Standard page sizes are letter, legal, A4 and A3 (portrait or landscape) or define your own custom page size. Column print control options allow you to create reports like the below periodic income statement (one of the standard reports) which automatically prints actual figures up to the reporting period and forecasted (budget) figures for the remainder of the year.

Conclusion

FR gives you the flexibility of a spreadsheet, however FRS is designed to be flexible enough to do all of your financial reporting, so if you are doing something in FR that can’t be done in FRS then, either you need to let us know so that we can improve FRS or what you are doing isn’t really financial reporting, but is in fact – well, spreadsheeting. Actually, some would argue that a spreadsheet is really too “flexible” for financial reporting and in fact many auditors won’t accept financial statements generated from a spreadsheet.

FRS is much easier to use and has more features like multi-company reporting, report sets, bulk emailing and scheduling. It’s also fully integrated which has numerous advantages, like your reports getting backed up with your data and not having to worry about Microsoft updating Excel and the FR no longer working. Of course, the biggest advantage FRS has is that FR doesn’t work with Sage 300c, whereas (once the web screens are completed) FRS will work on-premise, in the cloud or both at the same time. So even if you aren’t planning on moving to the cloud soon, using FRS for your on-premise financial reporting now, means that all the time and money you spend developing your reports is future-proofed and this alone will more than cover the cost of purchasing FRS.

FRS is available exclusively through all Sage 300 Business Partners and a 30-day demo is available for download from the Dingosoft website. When you order the product, you receive an activation code that turns the demo into a live product. Installation is a breeze – simply download and run the install exe from the Dingosoft website, then go into Administrative Services / Data Activation to activate it. That’s it. We timed it and we went from starting the download to printing a balance sheet to screen in 1 minute 40 seconds. So why not download the demo, check it out and draw your own conclusion?

John Paterson – CEO Dingosoft